The puppy food market was USD 74 billion in 2016. North America accounted for the largest share, 35% of the worldwide market in 2016. The second-best market is Europe, followed by Asia-Pacific, which accounts for around 20% of the market proportion. This has accelerated uptrends throughout the globe. In North America, the United States holds the foremost marketplace percentage of pets and pet owners, which is predicted to register an excessive CAGR for 2017-2022 (the forecast duration).

Flavors and textures are becoming bolder, more complicated, true, and unique. The correlation between pet food and the modern-day codecs mixing freeze-dried bits with kibble or treats for texture variations makes puppy owners choose from more than a few kinds of shapes, textures, and flavors. Moreover, clean labeling continues to grow. Health-conscious clients look for permissible indulgences, like the smaller element sizes of treats or chocolates with healthier ingredients like chia seeds or yogurt. Pet treats are growing in terms of practical or other dietary blessings, allowing puppy proprietors to indulge their pets unfastened from guilt. New canine meal merchandise constituted eighty of the worldwide launches in 2015. The launches from September 2015 to September 2016 preserve the fitness-related trend intact in new merchandise using class. The share for cat food turned to around 68% globally. This fashion of health and wellbeing has made an excellent income for the manufacturers. A few instances in this context are Hill’s Ideal Balance, a brand new dog and cat food range that mixes herbal ingredients with Hill’s perfectly balanced vitamins, now available in South Africa. CORE® RawRev, a brand new excessive-protein grain-free product, is released through Wellness CORE®, a circle of grain-free, natural animal nutrition company relatives.

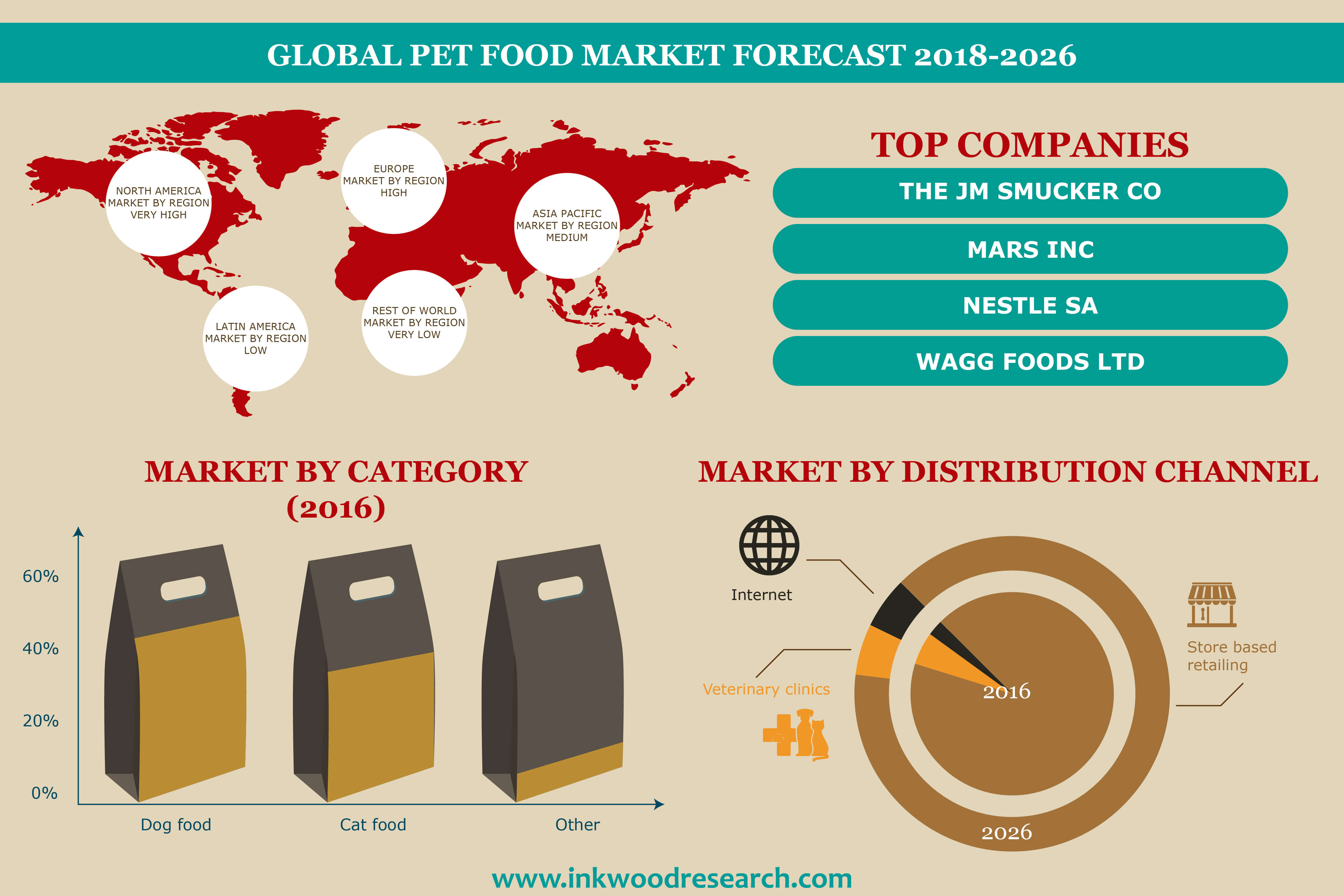

The high internet connectivity available in essential international locations boosts the use of e-trade sites as an effective distribution channel. The notions of convenience, affluence or exclusivity, protection, and marketplace recognition play a vital position in developing international locations. As indicated through the recent scandals, the unreliability of local items is also making human beings depend on foreign goods. These are made effortlessly available through e-commerce, making the income excessive. Owing to the enterprise’s two pet superstores, PetSmart and Petco, the e-commerce channel is exploding with puppy product income. The late embody of the marketplace connectivity within the small markets of small economies, including Vietnam, Thailand, etc., is a motive for infrastructure lag and almost negligible product awareness. These shops offer the nascent market advantages of low rules and opposition. Because e-commerce is strengthening, businesses are negotiating the ever-changing net landscape with the factors and managing giants like Amazon that areare deciding to sell through comparable e-commerce websites and mergers & acquisitions. For instance, in April 2017, PetSmart announced that it’d acquire Chewy.Com, which heightened the consternation in the unbiased puppy stores. In response, Tuffy’s Pet Food, a manufacturer of independent and family-owned agencies, announced that it would pull out its merchandise from Chewy, as the biggest US pet save chain owns it. Though Tuffy’s reviews no longer have superb responses, each organization no longer detaches itself without problems from huge e-commerce sites.

Though the customers these days are part-time vegetarians, they seem to do the opposite on pet food. Pet proprietors look for weight-reduction plan options that are conscious of the predatory nature of puppies and cats, thus driving various merchandise with excessive and clean meat claims. Despite the demand for carnivorous diets, vegetables are going mainstream, and the manufacturers are innovating their current merchandise. Free from the” for all-the-unfastened” trend, which has been growing for a few years and has now hit the mainstream, Pet foods are formulated to address human worries and include organic and non-GMO elements. These substances are used in low-carb recipes and have gluten-unfastened claims on new cereal merchandise that improved from one in 15 in 2011 to 1 in five in 2016. New product launches with organic or GMO-loose elements are witnessing a market boom. Organic and herbal meal sales are anticipated to grow 14.6% annually in the subsequent two years. For Petco and PetSmart, organic puppy ingredients are sold at 7.1% and five.6% price, respectively, with natural purchases at veterinary clinics at 5.Three%. Brands speak more about production techniques because of the rising consumer interest in herbal, authenticity, and transparency. This is proper for the shoppers, particularly those seeking products in non-conventional codecs, including raw, freeze-dried, frozen, and baked. Balchem Corp., the global health and nutrition employer, brought a new line of expertise, nutrients, and precise processing components. The Omega Plus variety was launched inside the South Island in September 2016, after two years of continuous R&D. In addition, Bob Martin released Simply+, with several merchandise advertised as “nutritionally advanced food that provides dogs with all the essentials of a healthful diet.”

The domestic marketplace is growing at an annual price above 30% in China. It is poised to accelerate on the identical fee in 2022, achieving CNY 150 billion and further, making it the third-largest marketplace worldwide. Moreover, Hangzhou in Zhejiang Province inaugurated the first move-border puppy industry experimental quarter inside the Jianggan District. The experimental area will pilot the reforms on the regulation and approval of pass-border imports. It will explore the creation of countrywide standards within the industry and promote the exportation of domestically made merchandise.

Moreover, more than 35 companies, consisting of cross-border e-trade sites like Tmall, Kaola Beibei, and related logistics and warehousing groups, were hooked up within the experimental sector. The quarter, essentially, permits one-forestall services and targets signing up for open, transparent, and clever pet meal import channels and regulatory rules. Similar efforts are being made to utilize the countries to recognize the growing pet population and trends. The marketplace players benefit from this example and invest in R&D for modern product launches.

German Company Entering Thailand. Intercell, a German-primarily based canine and cat food organization, entered the Thai enterprise by forming a joint venture named Happy Pet (Thailand) Co Ltd with associate Technic Pet Holding, reported Pets International. Intercell holds forty-nine % of the joint assignment and owns the top-rated Happy Dog and Happy Cat brands.